Richmond bankruptcy attorney Can Be Fun For Anyone

As bankruptcy lawyers in Fairfax VA, we determine eligibility for personal debt reduction by reviewing economical documentation and applicable Virginia bankruptcy law:

Mr. Moreton understands that there is no substitution for effort and preparing With regards to resolving sophisticated and psychological issues.

After your Assembly with the creditors, you will have to take a next financial debt counseling system. This will let you comprehend your recent spending plan and how to handle your debts heading ahead.

Steve is really an attorney at Fiscal Liberty Authorized in Richmond, VA. His apply concentrates on representing and guarding the legal rights of shoppers in bankruptcy proceedings. Steve has extensive working experience practicing bankruptcy law, obtaining represented the two debtors and creditors in bankruptcy proceedings. Because 2014, he has represented consumers completely, and he has helped thousands of clients file bankruptcy and navigate the bankruptcy method.

I help persons acquire a contemporary begin and get back money balance. Within the really commencing of my legal job, I have centered my observe solely on symbolizing shoppers in Chapter seven and Chapter thirteen bankruptcy scenarios.

• Distinguished: An outstanding ranking for a lawyer with a few experience. This rating signifies the attorney is widely highly regarded by their friends for top professional achievement and ethical criteria.

When I 1st met Richard, I realized immediately I'd made the only option. I truly am grateful for Richard’s homework and hard work. Bryan J. Watch total assessment here

Martindale-Hubbell validates that a reviewer is anyone with a sound electronic mail deal with. As Element of the assessment course of action, respondents need to affirm that they've had an Preliminary consultation, are at present a customer or are a client in the lawyer or legislation organization discovered, Even though Martindale-Hubbell cannot verify the lawyer/customer connection because it is usually private. The content of your responses is solely from reviewers.

All reviewers are confirmed as attorneys check this by means of Martindale-Hubbell’s substantial attorney database. Only attorneys practising at least 3 many years and acquiring a enough number of testimonials from non-affiliated attorneys are eligible to receive a Ranking.

History A chapter thirteen bankruptcy is also called a wage earner's program. It allows persons with regular earnings to produce a decide to repay all or aspect in their debts. Below this chapter, debtors propose a repayment intend to make installments to creditors in excess of a few to 5 years. If the debtor's present regular monthly profits is fewer than the applicable state median, the program is going to be for 3 decades Except the court docket approves an extended interval "for bring about." (1) In case the debtor's latest every month income is bigger compared to relevant point out median, the strategy commonly needs to be for 5 years. In no circumstance may a program present for payments in excess of a interval for a longer time than 5 years. eleven U.S.C. § 1322(d). Through this time the regulation forbids creditors from beginning or continuing selection attempts. This chapter discusses six facets of a chapter 13 proceeding: the advantages of selecting chapter thirteen, the Related Site chapter thirteen eligibility necessities, how a chapter thirteen continuing performs, generating the program perform, as well as the Particular chapter 13 discharge. Advantages of Chapter thirteen Chapter thirteen presents men and women a amount of advantages over liquidation less than chapter seven. Possibly most significantly, chapter thirteen presents men and women an opportunity to save their households from foreclosure.

Thinking if it is best to file for bankruptcy just before or following a divorce? The answer to that depends upon your financial problem. If you come imp source in in your free of charge Original consultation, we’ll clarify which option can be in your best desire.

There's no shame in needing support to have away from credit card debt. A position loss, a having difficulties organization, unpredicted health care bills — these are definitely every day occurrences.

Often named a “clean start off” bankruptcy, a “clear slate” bankruptcy or possibly a “liquidation,” Chapter 7 bankruptcy is The obvious way to just take control of your monetary problem and begin in excess of by eliminating site web your debts. In Chapter seven you can wipe out your bank card debts, health care charges, payday loans, lawsuits, judgments, unpaid balances on repossessions or foreclosures, private loans, assures and more.

Stage one – Accumulate Documents – Gather your economical files to ensure you and your attorney can overview your debts plus your Over-all monetary overall health and focus on regardless of whether a bankruptcy submitting is suitable. This really this article is the first step in the method.

Jennifer Grey Then & Now!

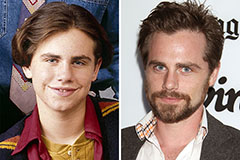

Jennifer Grey Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!